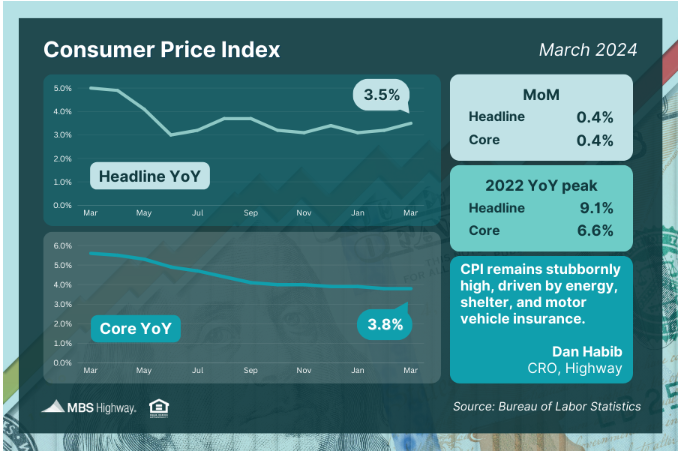

The latest Consumer Price Index (CPI) showed higher than expected inflation in March, with the headline reading up 0.4% from February. On an annual basis, CPI moved in the wrong direction, rising from 3.2% to 3.5%. The Core measure, which strips out volatile food and energy prices, increased 0.4% while that annual reading remained at 3.8% (though it was expected to decline to 3.7%).

What’s the bottom line? March’s hotter than expected consumer inflation report continues a trend we’ve seen in recent months, as rising energy and shelter costs have added to pricing pressure.

Price stability is part of the Fed’s dual mandate. When inflation became rampant a few years ago, the Fed began aggressively hiking their benchmark Fed Funds Rate (the overnight borrowing rate for banks) to slow the economy and rein in inflation. While inflation has fallen considerably after peaking in 2022, the progress lower has slowed, which could delay the Fed’s timing for rate cuts this year.

Given that maximum employment is the other part of the Fed’s dual mandate, a cooling job market with rising unemployment could pressure them to cut the Fed Funds Rate sooner rather than later. However, the overall strength of March’s Jobs Report, including the falling unemployment rate, will likely not add any pressure to their timeline.

Wholesale Inflation Better Than Feared

The Producer Price Index (PPI), which measures inflation on the wholesale level, rose 0.2% in March, just below estimates. On an annual basis, PPI rose from 1.6% to 2.1%, but this was better than the 2.2% estimate. Core PPI, which strips out volatile food and energy prices, was in line with forecasts at a 0.2% rise. The year-over-year reading rose from 2% to 2.4%, just above forecasts.

What’s the bottom line? Overall, the monthly PPI readings were tame and better than feared, which was a relief after the hot CPI readings that were reported the previous day. Plus, some of the PPI components are factored into another important consumer inflation measure called Personal Consumption Expenditures (PCE), which is the Fed’s favored measure, and this could potentially lead to a slightly better PCE report when that data is released on April 26.

Continuing Unemployment Claims Top 1.8 Million

Initial Jobless Claims fell by 11,000 in the latest week, retreating from a two-month high, as 211,000 people filed for unemployment benefits for the first time. However, Continuing Claims surged higher by 28,000, with 1.817 million people still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims can be volatile from week to week, but their relatively low level suggests that employers are still trying to hold on to their workers.

Yet, Continuing Claims are still trending higher near some of the hottest levels we’ve seen since November 2021, as it’s become harder for some people to find new employment once they are let go. This coincides with the New York Fed’s latest Survey of Consumer Expectations. Respondents noted that the mean probability of finding a job within three months of losing one is now at the lowest level in almost three years.

Latest on Small Business Optimism…or Lack Thereof

The National Federation of Independent Business (NFIB) Small Business Optimism Index fell to 88.5 in March. This is the weakest reading since December 2012 as “owners continue to manage numerous economic headwinds,” per Chief Economist Bill Dunkelberg.

What’s the bottom line? The NFIB noted that inflation is back on top as the biggest problem small businesses are facing, as owners are likely feeling the impact of higher oil prices and the stalling progress on reducing pricing pressure. Plans to hire also fell for the fourth straight month. Despite talk of a strong economy, small businesses are still feeling pessimistic.

Family Hack of the Week

It’s National Grilled Cheese Month. This Cheddar and Apple Grilled Cheese Sandwich from the Food Network is equally parts gooey and delicious – everything grilled cheese should be! Yields two sandwiches.

Thinly slice half an apple. Place 2 slices of sourdough bread on a cutting board. Top each with two slices of cheddar cheese, the apple slices, a third slice of cheese and another piece of bread. Press down lightly.

In a large skillet, heat 1 tablespoon butter over medium-low heat. Add the sandwiches and cook until the bread toasts and the cheese is slightly melted, about 3 to 5 minutes. Flip with a spatula and add another tablespoon of butter to the pan. Cook until the other side is toasted and the cheese is melted, around 3 minutes more. Adjust the heat as needed to keep the bread from burning before the cheese melts.

Enjoy with your favorite soup, side or simply on its own!

What to Look for This Week

We’ll kick off the week Monday with an update on home builder sentiment for this month. Tuesday brings news on March’s Housing Starts and Building Permits, while Existing Home Sales data follows on Thursday.

We’ll also get an update on March’s Retail Sales and the latest manufacturing data for the New York region on Monday. Jobless Claims and manufacturing for Philadelphia will be reported Thursday.

Technical Picture

After last Wednesday’s sharp decline due to the higher-than-expected CPI numbers, Mortgage Bonds were able to bounce higher off support at 99.647 on Friday. The 10-year ended last week trading at around 4.52%. While this is still high, it’s an improvement from highs hit earlier in the week.

Fun Things to do this week…

Ceasefire—Aaron Hankins at One Grand Gallery

One Grand Gallery presents an endurance and protest art installation by Portland-based maker Aaron Hankins. “Ceasefire” will open on April 5th…

When: Dates thru May 10, 6–9 pm

Where: One Grand Gallery Buckman | 1000 E Burnside Portland, Oregon 97214

Steep in Words

Immerse yourself in the fine art of poetry against the backdrop of the exquisite beauty of Lan Su in spring. Talented local poets offer readings and workshops tailored to inspire and refine your writing craft. Enjoy the sublime combination of poetry readings and the art of tea in our teahouse. Amidst the delicate fragrance of blossoms and the soothing sounds of trickling water, this harmonious convergence of literary expression and cultural refinement offers a soul-nourishing experience unlike any other.

When: Dates through April 28

Where: Lan Su Chinese Garden Old Town-Chinatown | 239 NW Everett Portland, OR 97201

THIS WEEKS REAL ESTATE UPDATE

Numbers help tell a story.

Numbers are powerful, especially when it comes to real estate! Whether you are assess whether it’s a good time to buy, sale or invest these numbers can be very valuable in determining offers or best sales price! PLEASE FEEL FREE TO REACH OUT WITH ANY QUESTIONS

Portland, OR 97230

Wed Apr 17 2024

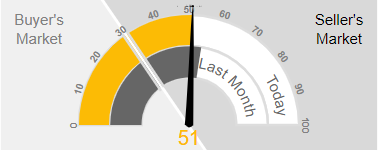

This week the median list price for Portland, OR 97230 is $499,950 with the market action index hovering around 51. This is less than last month’s market action index of 52. Inventory has increased to 48.

Market Action Index

This answers “How’s the Market?” by comparing rate of sales versus inventory.

Strong Seller’s Market

In the last few weeks the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

Portland, OR 97220

Wed Apr 17 2024

This week the median list price for Portland, OR 97220 is $450,000 with the market action index hovering around 62. This is an increase over last month’s market action index of 54. Inventory has decreased to 29.

Fairview, OR 97024

Wed Apr 17 2024

This week the median list price for Fairview, OR 97024 is $624,950 with the market action index hovering around 54. This is an increase over last month’s market action index of 52. Inventory has increased to 6.

Troutdale, OR 97060

Wed Apr 17 2024

This week the median list price for Troutdale, OR 97060 is $610,950 with the market action index hovering around 62. This is an increase over last month’s market action index of 56. Inventory has decreased to 6.

Gresham, OR 97080

Wed Apr 17 2024

This week the median list price for Gresham, OR 97080 is $550,700 with the market action index hovering around 44. This is about the same as last month’s market action index of 44. Inventory has decreased to 68.

Portland, OR 97236

Wed Apr 17 2024

This week the median list price for Portland, OR 97236 is $509,949 with the market action index hovering around 44. This is an increase over last month’s market action index of 41. Inventory has increased to 36.

Portland, OR 97211

Wed Apr 17 2024

This week the median list price for Portland, OR 97211 is $525,000 with the market action index hovering around 57. This is an increase over last month’s market action index of 52. Inventory has increased to 37.

Portland, OR 97232

Wed Apr 17 2024

This week the median list price for Portland, OR 97232 is $789,000 with the market action index hovering around 69. This is an increase over last month’s market action index of 60. Inventory has decreased to 3.

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why? The answer is complicated because there’s a lot that can influence mortgage rates. Here are just a few of the most impactful factors at play. Read more

Experts Project Home Prices Will Increase in 2024

Even though home prices are going up nationally, some people are still worried they might come down. In fact, a recent survey from Fannie Mae found that 24% of people think home prices will actually decline over the next 12 months. That means almost one out of every four people are dealing with that fear, and you might be, too. Read more

Have you heard of HOMEBOT?

Find out everything you need to know about your homes current value here! Learn more

Are you thinking about selling your home?

FIND OUT HOW MUCH YOUR HOME IS WORTH?

RECIPE OF THE WEEK!

Brown Sugar BBQ Chicken

Ingredient Checklist

- 2 lb. boneless skinless chicken breasts

- 1 c. barbecue sauce, plus more for serving

- 1/2 c. packed light or brown sugar

- 1/4 c. bourbon

- 1/4 c. Italian dressing

- 2 tsp. garlic powder

- 1 tsp. paprika

- Kosher salt

- Freshly ground black pepper

- 6 potato buns

- Coleslaw, for serving

Instructions Checklist

- In a slow-cooker, combine chicken breasts, barbecue sauce, brown sugar, bourbon, Italian dressing, garlic powder and paprika. Season with salt and pepper.

- Toss until well coated, then cover and cook on high for 4 hours or on low for 6 hours.

- Shred chicken and serve on buns with a drizzle of barbecue sauce and a spoonful of coleslaw.

Looking for the new home? Search Here!

North Portland

Northeast Portland

Northwest Portland

Portland Southeast

Southwest Portland

Gresham

OPEN HOUSES

DO YOU KNOW SOMEONE WITH REAL ESTATE NEEDS

It’s as simple as clicking a button, send referral! If seeing our name reminded you of a friend, family member, coworker that may need some real estate guidance, we’d love to help. All you have to do is click the button below, share some simple info, and we’ll get in touch with them to find out how we can best serve their needs.

REFER A FRIEND

Leave a Reply