Week of January 29, 2024 in Review

The Fed held rates steady, while there were mixed messages from the labor sector and

home prices continued to hit new highs. Read on for these stories and more:

– Fed Funds Rate “Likely at Its Peak”

– Was January’s Jobs Report Really a Blockbuster?

– Slow Start for Private Sector Job Growth

– Surprising Uptick in December’s Job Openings

– Unemployment Claims Rise for Second Straight Week

– Home Prices Moving on Up

Fed Funds Rate “Likely at Its Peak”

After a period of aggressive rate hikes that began in March 2022, the Fed once again

left their benchmark Federal Funds Rate unchanged at a range of 5.25% to 5.5%. This decision was unanimous and marked the fourth straight meeting where the Fed paused additional hikes.

The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not

the same as mortgage rates. The Fed’s eleven hikes between March 2022 and July

2023 were made to slow the economy and curb the runaway inflation seen over the last few years.

What’s the bottom line? The Fed said they believe they have reached their peak Fed Funds Rate for this cycle. However, members don’t expect to begin cutting rates until they have “gained greater confidence that inflation is moving sustainably toward 2 percent.” Note that the Fed’s favored measure, Core Personal Consumption Expenditures, declined to 2.9% annually as of the latest report for December.

During his press conference, Fed Chair Jerome Powell acknowledged that inflation data has been favorable over the last six months. However, he does not think the Fed will be ready to start cutting rates at their next meeting on March 20, explaining that members want to see “more good data.”

Was January’s Jobs Report Really a Blockbuster?

The Bureau of Labor Statistics (BLS) reported that there were 353,000 jobs created in January, which was nearly double expectations. Revisions to November and December also added 126,000 jobs in those months combined. The unemployment rate held steady at 3.7%.

What’s the bottom line? While the headline job growth figure for January appears

strong on the surface, future revisions lower are a very real possibility. January is

always a heavily adjusted month, as new benchmarks, seasonal adjustments and

population controls play a big role in calculating the data.

In addition, there are two reports within the Jobs Report and there is a fundamental

difference between them. The Business Survey is where the headline job number

comes from, and it’s based predominately on modeling and estimations.

The Household Survey, where the Unemployment Rate comes from, is considered

more real-time because it’s derived by calling households to see if they are employed.

This survey has its own job creation component and it told a completely different story, showing 31,000 job losses.

Average weekly hours worked also declined to the lowest level since 2010 excluding the pandemic. This is important because one of the ways businesses cut costs is to cut the number of hours worked. On average the entire labor force is working 30 minutes fewer per week, which equates to 2.4 million job losses on its own.

Slow Start for Private Sector Job Growth

ADP’s Employment Report showed that private payrolls began 2024 slower than

expected, as employers added just 107,000 new jobs in January. Most of the growth

came in service-providing industries (+77K), with goods-producers adding the rest.

Annual pay for job stayers increased by 5.2% while job changers saw an average

increase of 7.2%, though these figures have cooled considerably from recent highs. In addition, the difference between pay growth for job stayers versus job changers has also shrunk substantially, indicating there’s less incentive for switching jobs.

What’s the bottom line? Nela Richardson, chief economist for ADP, said, “Progress on inflation has brightened the economic picture despite a slowdown in hiring and pay.” She also noted that “wages adjusted for inflation have improved over the past six months, and the economy looks like it's headed toward a soft landing in the U.S. and globally.”

Surprising Uptick in December’s Job Openings

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings were stronger than expected in December, rising from 8.925 million in November to 9.026 million. The hiring rate rose from 3.5% to 3.6% while the quit rate remained at 2.2%, suggesting there’s a lack of employers trying to entice workers with other offers.

What’s the bottom line? While the Fed watches this report to monitor slack in the labor market, there are flaws in the data. The increase in working from home means job listings are being posted in multiple states more frequently. As a result, they’re being overcounted in the JOLTS total so the report may be weaker than the headlines suggest, especially given the number of high-profile companies that have announced layoffs recently.

Unemployment Claims Rise for Second Straight Week

The latest weekly Initial Jobless Claims reached their highest level since November, as 224,000 people filed for unemployment benefits for the first time. Continuing Claims also surged higher, up 70,000 with 1.898 million people still receiving benefits after filing their initial claim.

What’s the bottom line? Both Initial and Continuing Jobless Claims have risen over

the last two weeks to nearly three-month highs. Plus, the latest Job Cuts report from

Challenger, Gray & Christmas showed that announced layoffs in January surged from December, and this could be reflected in future Unemployment Claim filings.

Home Prices Moving on Up

The Case-Shiller Home Price Index, which is considered the “gold standard” for

appreciation, showed home prices nationwide rose 0.2% from October to November

after seasonal adjustment. This marked the tenth straight month of gains and a new

record high. Home values in November were also 5.1% higher than a year earlier, with S&P DJI’s Head of Commodities, Brian D. Luke, noting that “November’s year-over-year gain saw the largest growth in U.S. home prices in 2023.”

The Federal Housing Finance Agency’s (FHFA) House Price Index also saw home

prices rise 0.3% from October to November and 6.6% year-over-year, with their index

setting new record highs in home prices every month since February.

Note that FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans, and these factors account for some of the differences in the two reports.

What’s the bottom line? Home prices are on pace to rise between 6-7% in 2023,

based on the reported pace of appreciation through November. These indexes show

that homeownership continues to provide opportunities for building wealth through real estate.

Family Hack of the Week

These crowd-pleasing Baked Chicken Wings from Allrecipes are easy to make and

perfect for game day or any favorite celebration!

Preheat oven to 375 degrees Fahrenheit. In a large resealable bag, combine 3

tablespoons olive oil, 3 cloves pressed garlic, 2 teaspoons chili powder, 1 teaspoon

garlic powder, and salt and pepper to taste.

Add 10 to 12 chicken wings to the bag, reseal and shake to coat. Arrange chicken wings in a single layer on a baking sheet. Cook until wings are crisp, about 30 to 45 minutes. Enjoy wings with classics like Ranch dressing, carrots and celery sticks!

What to Look for This Week

This week’s economic calendar is much quieter than last week’s but there are a few key items to note. The latest Jobless Claims will be delivered on Thursday while investors will also be closely watching Wednesday’s 10-year Note and Thursday’s 30-year Bond auctions for the level of demand.

Technical Picture

Mortgage Bonds broke beneath their 25-day Moving Average on Friday and ended last week testing the next floor of support at their 50-day Moving Average. The 10-year ended last week just beneath resistance at the 25-day Moving Average. If this ceiling does not hold, there are three resistance levels close by.

Fun Things to do this week…

Oregon Craft Beer Month

It’s the hoppiest time of the year for brewheads: Oregon Craft Beer Month! Mark your calendar for a plethora of beer-based programming throughout February, including special releases, brewery highlights, and more, organized with the aim of stoking activity during one of the slowest months of the year for small businesses.

When: Every day, through Feb 25

SAVØR: Rose City’s Zero Proof Week

The app BuzzCutt aims to make it easy to pursue a “sober-curious” lifestyle by displaying nearby bars, restaurants, markets, and grocery stores serving non-alcoholic options. On the heels of Dry January, they’re throwing a week-long zero-proof extravaganza in partnership with the Portland Mercury.

When: Every day, through Feb 10

THIS WEEKS REAL ESTATE UPDATE

Numbers help tell a story.

Numbers are powerful, especially when it comes to real estate! Whether you are assess whether it’s a good time to buy, sale or invest these numbers can be very valuable in determining offers or best sales price! PLEASE FEEL FREE TO REACH OUT WITH ANY QUESTIONS

Portland, OR 97230

Wed Feb 07 2024

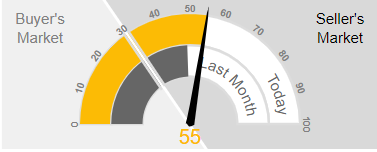

This week the median list price for Portland, OR 97230 is $487,900 with the market action index hovering around 55. This is an increase over last month’s market action index of 49. Inventory has decreased to 37.

Market Action Index

This answers “How’s the Market?” by comparing rate of sales versus inventory.

Strong Seller’s Market

Home sales continue to outstrip supply and the Market Action Index has been moving higher for several weeks. This is a Seller’s market so watch for upward pricing pressure in the near future if the trend continues.

Portland, OR 97220

Wed Feb 07 2024

This week the median list price for Portland, OR 97220 is $425,900 with the market action index hovering around 46. This is less than last month’s market action index of 47. Inventory has increased to 37.

Fairview, OR 97024

Wed Feb 07 2024

This week the median list price for Fairview, OR 97024 is $619,000 with the market action index hovering around 43. This is less than last month’s market action index of 54. Inventory has increased to 5.

Troutdale, OR 97060

Wed Feb 07 2024

This week the median list price for Troutdale, OR 97060 is $550,000 with the market action index hovering around 55. This is an increase over last month’s market action index of 50. Inventory has held steady at or around 13.

Gresham, OR 97080

Wed Feb 07 2024

This week the median list price for Gresham, OR 97080 is $557,400 with the market action index hovering around 47. This is less than last month’s market action index of 48. Inventory has increased to 82.

Portland, OR 97236

Wed Feb 07 2024

This week the median list price for Portland, OR 97236 is $555,000 with the market action index hovering around 37. This is an increase over last month’s market action index of 36. Inventory has decreased to 35.

Portland, OR 97211

Wed Feb 07 2024

This week the median list price for Portland, OR 97211 is $612,500 with the market action index hovering around 53. This is less than last month’s market action index of 54. Inventory has increased to 34.

Portland, OR 97232

Wed Feb 07 2024

This week the median list price for Portland, OR 97232 is $849,000 with the market action index hovering around 57. This is an increase over last month’s market action index of 45. Inventory has decreased to 7.

Houses Are Still Selling Fast

Have you been thinking about selling your house? If so, here’s some good news. While the housing market isn’t as frenzied as it was during the ‘unicorn’ years when houses were selling quicker than ever, they’re still selling faster than normal. Read more

Why Having Your Own Agent Matters When Buying a New Construction Home

Finding the right home is one of the biggest challenges for potential buyers today. Right now, the supply of homes for sale is still low. But there is a bright spot. Read more

Have you heard of HOMEBOT?

Find out everything you need to know about your homes current value here! Learn more

Are you thinking about selling your home?

FIND OUT HOW MUCH YOUR HOME IS WORTH?

RECIPE OF THE WEEK!

Beef Stroganoff

Ingredient Checklist

- 8 oz. extra-wide egg noodles

- 4 tbsp. unsalted butter, divided

- 1 lb. skirt steak

- 2 tsp. kosher salt, plus more

- 4 tbsp. all-purpose flour, divided

- 3 tbsp. neutral oil

- 8 oz. baby bella mushrooms, sliced

- 2 large shallots, thinly sliced

- 3 cloves garlic, finely chopped

- 1 tbsp. Dijon mustard

- 1 tbsp. tomato paste

- 1 tbsp. Worcestershire sauce

- 2 c. low-sodium beef stock

- 1/2 c. full-bodied red wine

- 1/2 c. sour cream

- Chopped fresh parsley, for serving

Instructions Checklist

- In a large pot of boiling water, cook noodles, stirring occasionally, until al dente according to package instructions. Drain and transfer to a large bowl. Add 2 tablespoons butter and toss to combine.

- Meanwhile, slice steak with the grain into 2″-thick pieces. In a small bowl, mix salt and 3 tablespoons flour. In a large, shallow pan over medium-high heat, heat oil until shimmering. Test an edge of a piece of steak; if the sizzle is aggressive, it’s ready to go. Dredge steaks in flour mixture, shaking off excess. Cook, turning once, until deep golden brown, about 1 minute per side. Transfer to a cutting board.

- In same pan over medium-high heat, combine mushrooms, 1 tablespoon butter, and 1/4 cup water. Cook, stirring occasionally and scraping bottom of pan, until mushrooms are golden brown, 8 to 10 minutes; season with salt and stir to combine. Using a slotted spoon, transfer mushrooms to a plate.

- Reduce heat to low. Cook shallots, 3 tablespoons water, and remaining 2 tablespoons butter, stirring occasionally, until shallots are caramelized and taste sweet, 10 to 15 minutes.

- Add garlic and cook, stirring, until fragrant, about 1 minute. Increase heat to medium-high. Add mustard, tomato paste, and Worcestershire and cook, stirring, until paste is brick red, about 1 minute. Sprinkle with remaining 1 tablespoon flour and cook, stirring, until flour is toasted, about 1 minute. Pour in stock and wine and bring to a boil. Cook, stirring occasionally, until slightly reduced, about 5 minutes. Transfer 1/2 cup sauce to a small bowl; stir in sour cream.

- Thinly slice meat against the grain into 1/2″ strips. Return steak and mushrooms to pan and toss to combine. Add sour cream mixture and noodles to pan and cook, tossing constantly, until sauce thickens and coats noodles, about 3 minutes; season with salt.

- Divide beef stroganoff among plates. Top with parsley.

London Fog Drink

Indulgents

- 2 oz. Kahlúa

- 1 oz. vodka

- 1 oz. heavy cream

Instructions Checklist

- Fill a rocks glass with ice. In a small measuring cup, combine vodka and Kahlúa. Pour vodka mixture into glass, then pour cream over.

HOUSE FOR SALE

Looking for the new home? Search Here!

North Portland

Northeast Portland

Northwest Portland

Portland Southeast

Southwest Portland

Gresham

OPEN HOUSES

DO YOU KNOW SOMEONE WITH REAL ESTATE NEEDS

It’s as simple as clicking a button, send referral! If seeing our name reminded you of a friend, family member, coworker that may need some real estate guidance, we’d love to help. All you have to do is click the button below, share some simple info, and we’ll get in touch with them to find out how we can best serve their needs.

REFER A FRIEND

Leave a Reply